The Vanuatu Financial Services Commission is a well-known financial oversight institution that issues licenses to Forex brokers and exchanges . In the past few years , a growing number of Forex brokers and financial service providers have chosen to get licensed by the VFSC. This raises the question: Why do currency dealers and financial platforms prefer the VFSC over other regulatory bodies ? Understanding the draw of the VFSC involves a close look at its oversight approach , flexibility , and the distinct perks it offers to both institutions and clients .

International Reach with Easy Access One of the main reasons why financial companies are drawn to a VFSC regulatory stamp is the fact that it has relatively low barriers to entry . When compared to other financial regulators in places like the United Kingdom, US , or Australia , where compliance obligations are often tough and expensive , Vanuatu offers an more cost-effective alternative. The monetary thresholds for securing a VFSC license are significantly lower, making it a more accessible option for new brokers that are aiming to build presence in the market.

In markets such as the United States, brokers may need to provide millions in capital to comply with their regulatory framework. However, Vanuatu offers a much more manageable threshold. This reduced entry cost allows brokers to allocate more resources toward enhancing their client experience , developing customer support , or focusing on marketing , rather than spending a substantial portion on meeting strict legal standards .

Regulatory Flexibility Another major reason why brokers prefer the VFSC is its regulatory flexibility . While major financial hubs such as the UK’s FCA or the US’s CFTC impose strict guidelines and compliance measures, the VFSC provides a much more relaxed regulatory framework.

This regulatory ease allows brokers to offer increased leverage options and a broader range of financial instruments , which might be restricted under more stringent regulators . For instance, brokers operating under European laws are often restricted by maximum leverage ratios (such as low leverage limits), whereas VFSC-licensed brokers can offer leverage as high as 1000:1 or even more. This attracts traders who are comfortable with higher risk and want to amplify their trading positions .

For brokers, this means they can serve a broader range of clients , including high-risk investors who seek more flexible trading conditions . It also allows them to modify their products more quickly to meet market demands without being hampered by burdensome compliance processes .

Swift Regulatory Approval The efficiency of the VFSC's regulatory approval is another appealing factor. Compared to other financial oversight entities where the process of securing a license can take a long time , or even years, the VFSC offers a much faster turnaround. Brokers can often receive their compliance confirmations in just a matter of days .

This expedited licensing pathway enables brokers to commence operations more quickly, which is especially critical in a rapidly evolving sector like Forex, where new trading windows can arise and vanish quickly.

Reputation and Legal Standing Despite the reduced compliance hurdles, the VFSC maintains a solid global standing . Vanuatu is a member of international bodies like the IOSCO , and its regulatory framework aligns with global standards . For investors, a VFSC license still offers a level of credibility and security.

Although traders may view licenses from more established regulators like the FCA or ASIC as more renowned, brokers with a VFSC license can still offer a degree of compliance security. Brokers under the VFSC are mandated to follow certain fiscal benchmarks and demonstrate transparency , ensuring a degree of safety for traders.

International Expansion Potential Brokers licensed by the VFSC can operate internationally , serving clients from a wide range of territories without being confined to one geographic area . This is particularly appealing for brokers looking to grow their check out this information international presence , as they can offer services across Asia , and beyond, without needing to secure additional regulatory certifications in each country .

Conclusion

In conclusion, FX platforms and exchanges opt for VFSC another article accreditation because it is cost-effective , offers lenient compliance options , and provides fast licensing times . The VFSC strikes an attractive balance, allowing brokers to offer a wide range of products with minimal oversight interference. For traders, while the VFSC may not carry the same prestige as licenses from more strict oversight bodies, it still delivers credibility that appeals to many. As a result, the VFSC continues to be a go-to solution for brokers seeking to serve worldwide markets in the international currency trading arena.

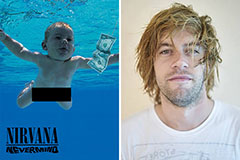

Spencer Elden Then & Now!

Spencer Elden Then & Now! Molly Ringwald Then & Now!

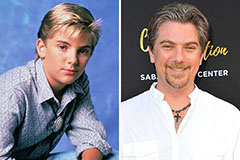

Molly Ringwald Then & Now! Jeremy Miller Then & Now!

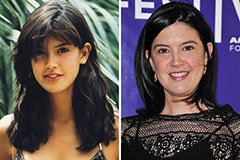

Jeremy Miller Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!